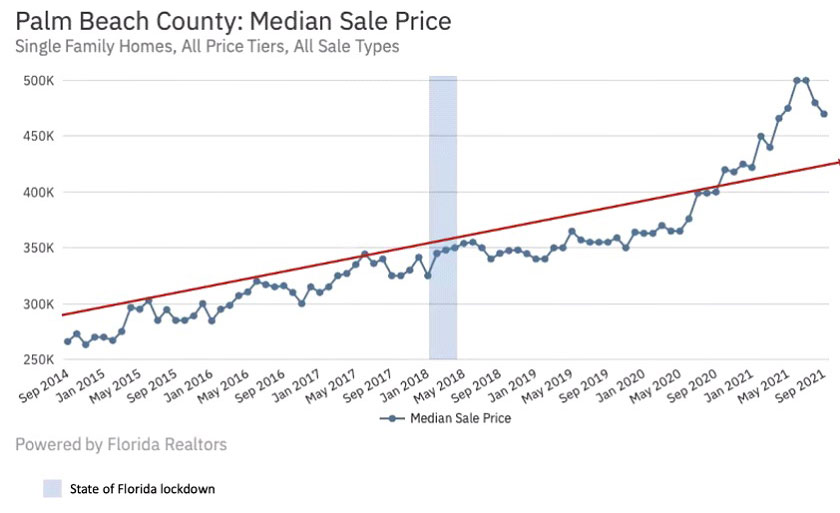

From 2020 to 2021, home prices rose by nearly 20% – an astonishing rate of growth that even outpaced growth rates from 2008 in the run-up to the housing crash. Naturally this begs the question: are we headed for the next bubble?

As we’re moving into the homestretch of 2021, Fannie Mae predicts that home prices will rise by 7.9% between the fourth quarter of this year and the same time next year at the end of 2022. An annual growth rate of nearly 8% would be a considered a slowdown compared to growth we’ve witnessed over the last 12 months or so, however, 7.9% is nearly double the average historical growth rate. Since 1987, according to the Federal Reserve Bank of St. Louis, home prices have grown by an average of 4.1% per year.

Other industry heavyweights like Zillow and Goldman Sachs predict an even more bullish market in 2022: While Zillow predicts U.S. home prices to increase by 13.9% from October 2021 to October 2022, the investment bank foresees home prices climbing 16% by the end of 2022. Even the most bearish forecast, published by CoreLogic, expects a 1.9% price growth over the next 12 months.

What continues to drive the demand?

Unlike the housing market in 2008, post-Covid housing market is not fueled by wide-spread speculation and built on shaky lending standards. This present housing market is driven by a number of factors:

- The largest generation alive, Millennials, are finally entering their first-time home-buying age. A huge group of buyers is about to enter the arena

- Primarily at the beginning of the pandemic record-low interest rates made the purchase of more expensive housing segments more affordable

- Huge gains in stock markets and Government aid flushed the market with cash, which many decided to re-invest in Real Estate

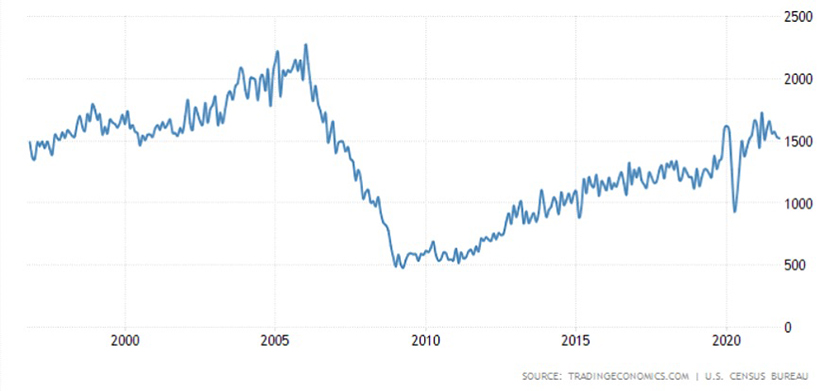

All of this came at a time when the U.S. housing market had already been consistently underserved. After the Great Recession, new housing starts plummeted and hovered on low levels until finally in 2021 growing back to where it used to be back in 2000!

To put the data into a wider context: since the year 2000, U.S. population has grown from 281 million to 331 million residents in 2020. That’s a net gain of 50 million people. At the same time, housing starts since 2000 have averaged ~ 1.3 million per year, which over 20 years add up to roughly 26 million new housing starts – that’s only half of the net population growth in the same period.

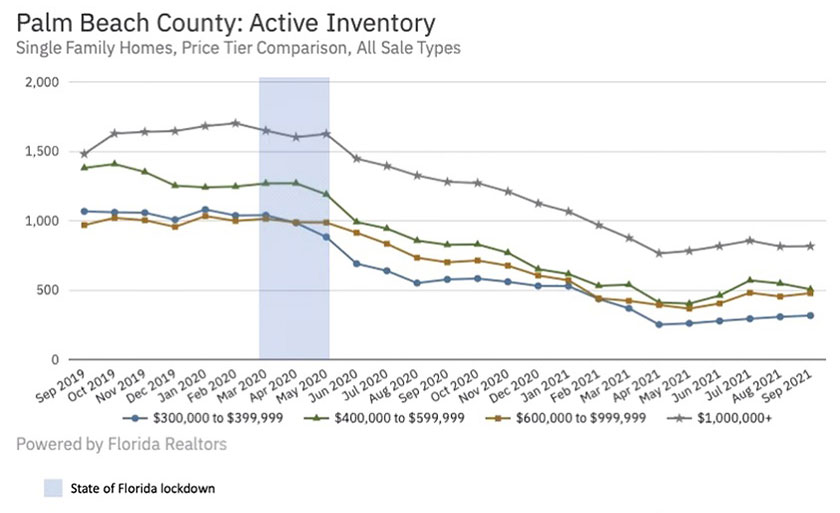

The obvious consequence of all these factors? A dramatic shortage of housing inventory, across all segments as the chart below shows:

The bottom line: There are simply not enough homes on the market to satisfy demand. We’re currently experiencing a seller’s market and unless something dramatic changes, this market environment is here to stay! As Goldman Sachs and other industry heavyweights have pointed out we will most likely not continue to see sales prices grow 20% year-over-year, however, every indicator points towards a continuation of strong price increases in 2022 and most likely for the near mid-term future, albeit at a slower pace.

Despite a very competitive environment, we at The MDL Group believe that interested buyers should consider not delaying home purchase plans. As we have pointed out in our analysis, many key indicators suggest a very strong, demographic-driven demand going forward. Rising inflation adds another layer of complexity to the mix which would make it seem even more favorable to purchase a home rather sooner than later.

Maximilian Dollar Listings is an experienced, top-rated Real Estate service firm with deep market knowledge in Southern Florida. It would be our pleasure to guide you through your home buying experience.

Make it a Maximilian Dollar Listing!

This website and other content herein are made available by Maximilian Dollar Listings solely for informational purposes. The information, statements, comments, views, and opinions expressed in this website do not constitute and should not be construed as an offer to buy or sell any real estate or securities or to make or consider any investment or course of action. The information, statements, comments, views, and opinions provided in this website are general in nature, and such information, statements, comments, views, and opinions are not intended to be and should not be construed as the provision of investment advice by Maximilian Dollar Listings.